Basel III is the third revision of the Basel Accord. It sets international standards regarding banks' capital adequacy requirements, stress testing and liquidity requirements. Basel II focused more on the capital structure. Basel III, however, is more comprehensive and includes many new regulations. These regulations can be applied to small and large banks. If you have questions about Basel III, ask your bank's CEO. You will find the CEO of your bank more than willing to help.

Capital contingent forms

Contingent forms capital (CFSs), which are debt securities that can be converted to equity at prearranged terms, allow troubled institutions to raise capital. These instruments reduce debt-to-equity ratios and can be an effective way to recapitalize institutions without initiating insolvency proceedings.

CFSs can be a useful tool for banks to meet Basel III requirements. The Basel III rules stipulate that banks must maintain a minimum ratio of capital to assets. Also, banks must have enough Tier 1 capital for extreme situations and to mitigate the consequences of bad loans.

Leverage ratio

Basel III framework is a crucial measure that banks institutions must consider when determining their leverage ratio. This ratio is calculated by subtracting the bank's Tier 1 capital from its total exposure. A low leverage percentage means that the bank doesn't face capital stress. A high leverage ratio indicates that the banking institution is experiencing stress. Valuations of balance-sheet items must conform to applicable accounting standards when determining the ratio.

Public disclosure of leverage ratios is required. According to the regulations, banks must report their leverage ratios every quarter. G-SIBs will be required to report their leverage ratios every quarter beginning June 2021.

Transition periods

Basel III contains new requirements for banks that will have an impact on the entire world. The agreement has certain requirements that all banks must meet, and it also sets transitional periods for the implementation of the standards. Transition periods are intended to minimize the impact of new requirements on existing businesses. When fully implemented, however, the new rules could have a significant effect on businesses. In this article, we will look at the specific requirements for Canada.

Basel III requires banks to comply with certain buffers as well as meet certain minimum capital requirements. Each of these minimum capital ratios will mandate that banks have certain levels of common equity or Tier 1 capital. Banks will be required to retain more of their earnings in capital under the new rules. This is done to improve safety in the banking system by requiring banks maintain greater capital levels in good times.

Phase-ins

Basel III implementation will bring up many issues. One of these is how phase-ins/outs are implemented. The Basel Committee has stated that the overall economic impact of the changes will be minimal, and that the greater systemic safety and stability benefits will outweigh the costs.

One issue that will emerge is the sensitivity for the risk-management indicator. Basel III will replace the proxy indicator and be more sensitive for operational risks. The new indicator will require banks to have ten years of high-quality operational loss data in order to calculate risk sensitivity. This new measure is only applicable to large banks and not small ones.

FAQ

What are the steps involved in making a decision in management?

Managers have to make complex decisions. It includes many factors such as analysis, strategy planning, implementation and measurement. Evaluation, feedback and feedback are just some of the other factors.

Remember that people are humans just like you, and will make mistakes. This is the key to managing them. As such, there is always room for improvement, especially if you're willing to put forth the effort to improve yourself first.

In this video, we explain what the decision-making process looks like in Management. We discuss the different types of decisions and why they are important, every manager should know how to navigate them. You'll learn about the following topics:

What is Kaizen?

Kaizen is a Japanese term which means "continuous improvement." This philosophy encourages employees to continually look for ways to improve the work environment.

Kaizen is a belief that everyone should have the ability to do their job well.

How to manage employees effectively?

Achieving employee happiness and productivity is key to managing them effectively.

It is important to set clear expectations about their behavior and keep track of their performance.

Managers need clear goals to be able to accomplish this.

They need to communicate clearly and openly with staff members. They also need to make sure that they discipline and reward the best performers.

They must also keep track of the activities of their team. These include:

-

What did we accomplish?

-

What was the work involved?

-

Who did it, anyway?

-

What was the moment it was completed?

-

Why it was done?

This information is useful for monitoring performance and evaluating the results.

What is the difference between leadership and management?

Leadership is about being a leader. Management is about controlling others.

Leaders inspire followers, while managers direct workers.

A leader inspires others to succeed, while a manager helps workers stay on task.

A leader develops people; a manager manages people.

What is a simple management tool that aids in decision-making and decision making?

A decision matrix, a simple yet powerful tool for managers to make decisions, is the best. It allows them to think through all possible options.

A decision matrix represents alternatives in rows and columns. This makes it easy to see how each alternative affects other choices.

In this example, we have four possible alternatives represented by the boxes on the left side of the matrix. Each box represents a different option. The top row represents the current state of affairs, and the bottom row is indicative of what would happen in the event that nothing were done.

The middle column displays the impact of selecting Option 1. In this case, it would mean increasing sales from $2 million to $3 million.

The results of choosing Option 2 and 3 can be seen in the columns below. These positive changes result in increased sales of $1 million and $500,000. They also have negative consequences. Option 2 can increase costs by $100 million, while Option 3 can reduce profits by $200,000.

The final column shows the results for Option 4. This will result in sales falling by $1,000,000

The best thing about a decision matrix is the fact that you don't have to remember which numbers go with what. You can just glance at the cells and see immediately if one given choice is better.

This is because the matrix has done all the hard work. It is as simple as comparing the numbers within the relevant cells.

Here's a sample of how you might use decision matrixes in your business.

Advertising is a decision that you make. You'll be able increase your monthly revenue by $5000 if you do. You'll also have additional expenses up to $10,000.

Look at the cell immediately below the one that states "Advertising" to calculate the net investment in advertising. It's $15,000. Advertising is a worthwhile investment because it has a higher return than the costs.

Why is it so hard to make smart business decisions?

Complex systems are often complex and have many moving parts. Their leaders must manage multiple priorities, as well as dealing with uncertainty.

The key to making good decisions is to understand how these factors affect the system as a whole.

It is important to consider the functions and reasons for each part of the system. It's important to also consider how they interact with each other.

You need to ask yourself if your previous actions have led you to make unfounded assumptions. If they don't, you may want to reconsider them.

Try asking for help from another person if you're still stuck. They may see things differently from you and have insights that could help you find a solution.

Why is it important that companies use project management methods?

To ensure projects run smoothly and meet deadlines, project management techniques are employed.

This is because most businesses rely on project work for their products and services.

Companies must manage these projects effectively and efficiently.

Without effective project management, companies may lose money, time, and reputation.

Statistics

- Hire the top business lawyers and save up to 60% on legal fees (upcounsel.com)

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

External Links

How To

How can you create a Quality Management Plan, (QMP)?

QMP (Quality Management Plan), introduced in ISO 9001,2008, provides a systematic method for improving processes, products, or services through continuous improvement. It focuses on the ability to measure, analyze and control processes and customer satisfaction.

QMP stands for Quality Management Process. It is used to guarantee good business performance. QMP improves production, service delivery, as well as customer relations. QMPs should encompass all three components - Products and Services, as well as Processes. When the QMP includes only one aspect, it is called a "Process" QMP. QMPs that focus on a Product/Service are known as "Product" QMPs. If the QMP focuses on Customer Relationships, it's called a "Product" QMP.

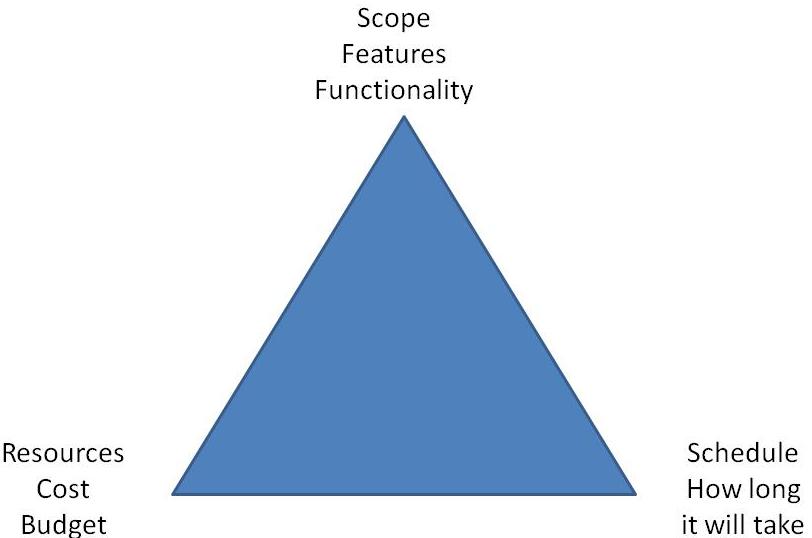

Two main elements are required for the implementation of a QMP. They are Scope and Strategy. These are the following:

Scope: This determines the scope and duration of the QMP. This scope can be used to determine activities for the first six-months of implementation of a QMP in your company.

Strategy: These are the steps taken in order to reach the goals listed in the scope.

A typical QMP has five phases: Planning (Design, Development), Implementation (Implementation), and Maintenance. Each phase is explained below:

Planning: This stage is where the QMP objectives are identified and prioritized. To get to know the expectations and requirements, all stakeholders are consulted. Next, you will need to identify the objectives and priorities. The strategy for achieving them is developed.

Design: During this stage, the design team develops the vision, mission, strategies, and tactics required for the successful implementation of the QMP. These strategies can be implemented through the creation of detailed plans.

Development: The development team is responsible for building the resources and capabilities necessary to implement the QMP effectively.

Implementation: This involves the actual implementation of the QMP using the planned strategies.

Maintenance: It is an ongoing process that maintains the QMP over time.

The QMP must also include several other items:

Participation by Stakeholders is essential for the QMP's continued success. They must be involved in all phases of the QMP's development, planning, execution, maintenance, and design.

Project Initiation - A clear understanding of the problem statement, and the solution is necessary for any project to be initiated. The initiator must know the reason they are doing something and the expected outcome.

Time Frame: It is important to consider the QMP's time frame. If you plan to implement the QMP for a short period, you can start with a simple version. If you're looking to implement the QMP over a longer period of time, you may need more detailed versions.

Cost Estimation is another important aspect of the QMP. Without knowing how much you will spend, planning is impossible. It is therefore important to calculate the cost before you start the QMP.

QMPs are not just a written document. They should be a living document. It is constantly changing as the company changes. It should therefore be reviewed frequently to ensure that the organization's needs are met.